How Will Extended Digital Outages Shape the Technology Resilience Narrative for CBA (ASX:CBA)?

- Earlier this week, Commonwealth Bank of Australia experienced a planned system maintenance that lasted longer than expected, leaving many customers unable to use their cards for purchases and causing payment disruptions across its network.

- This incident not only led to frustration and embarrassment for affected customers but also raised fresh concerns about the resilience and reliability of digital banking platforms during critical periods.

- Let’s now examine how this extended banking outage might influence Commonwealth Bank of Australia’s investment narrative, especially regarding technology reliability risks.

We’ve found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Commonwealth Bank of Australia Investment Narrative Recap

To be a shareholder in Commonwealth Bank of Australia, you generally need to believe in the ongoing digital transformation of the bank and its ability to maintain operational excellence in a highly competitive market. The recent extended outage puts a spotlight on technology reliability risks, which, while frustrating for customers, do not appear to significantly alter the bank’s most important short-term catalysts, such as its digital growth or cost-saving initiatives, but do highlight the need for constant attention to technology infrastructure, which is now a key business risk for all major banks.

Among recent company announcements, the August 13, 2025 extension of the share buyback program stands out most in this context. While share buybacks typically support investor returns and reflect management’s confidence in the company’s financial strength, technology reliability now comes into sharper focus as a potential limiting factor for future growth, particularly in an industry where customer trust and digital capability are intertwined.

Yet, despite the bank’s history of resilience, investors should be aware that ongoing incidents like this raise new questions about…

Read the full narrative on Commonwealth Bank of Australia (it’s free!)

Commonwealth Bank of Australia’s outlook anticipates A$31.9 billion in revenue and A$11.2 billion in earnings by 2028. This reflects a projected annual revenue growth rate of 4.9% and an earnings increase of A$1.1 billion from current earnings of A$10.1 billion.

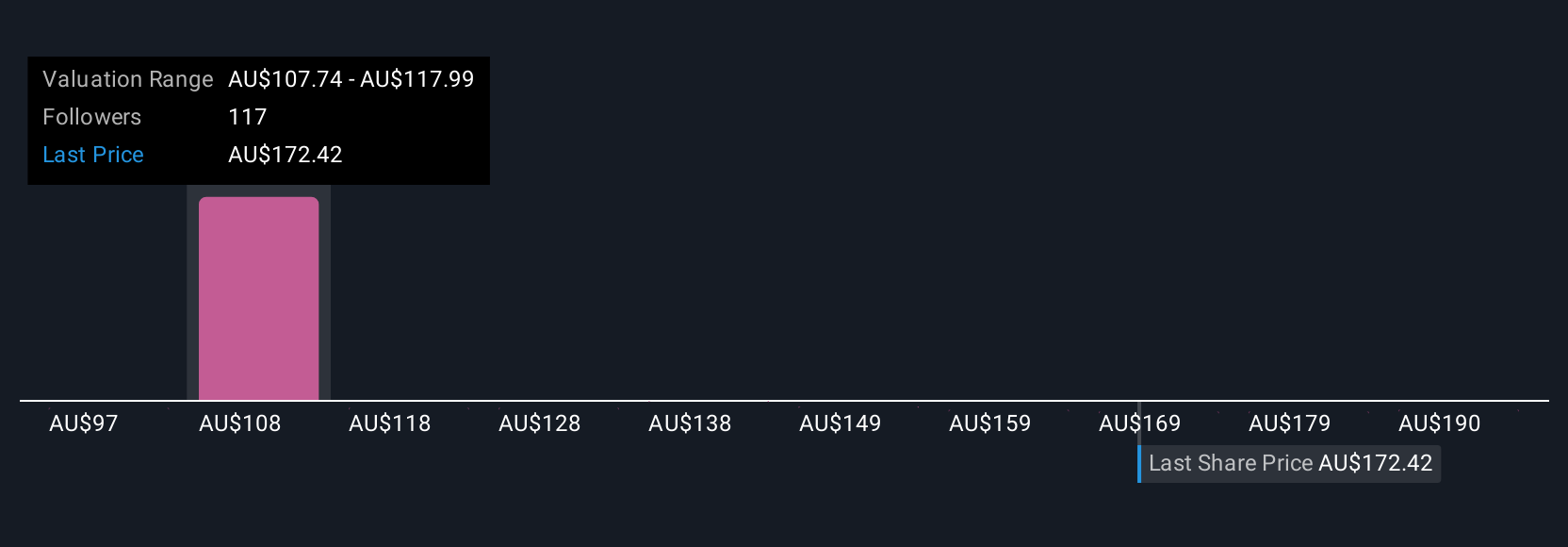

Uncover how Commonwealth Bank of Australia’s forecasts yield a A$120.47 fair value, a 27% downside to its current price.

Exploring Other Perspectives

Fair value estimates from 18 Simply Wall St Community members for Commonwealth Bank of Australia range from A$93.33 to A$200. In contrast, ongoing digital disruption and technology reliability are increasingly relevant to how different investors see the future performance of the business.

Explore 18 other fair value estimates on Commonwealth Bank of Australia – why the stock might be worth as much as 22% more than the current price!

Build Your Own Commonwealth Bank of Australia Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Contemplating Other Strategies?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

link