Healthcare Data Technology Market Size Report, 2033

Healthcare Data Technology Market Summary

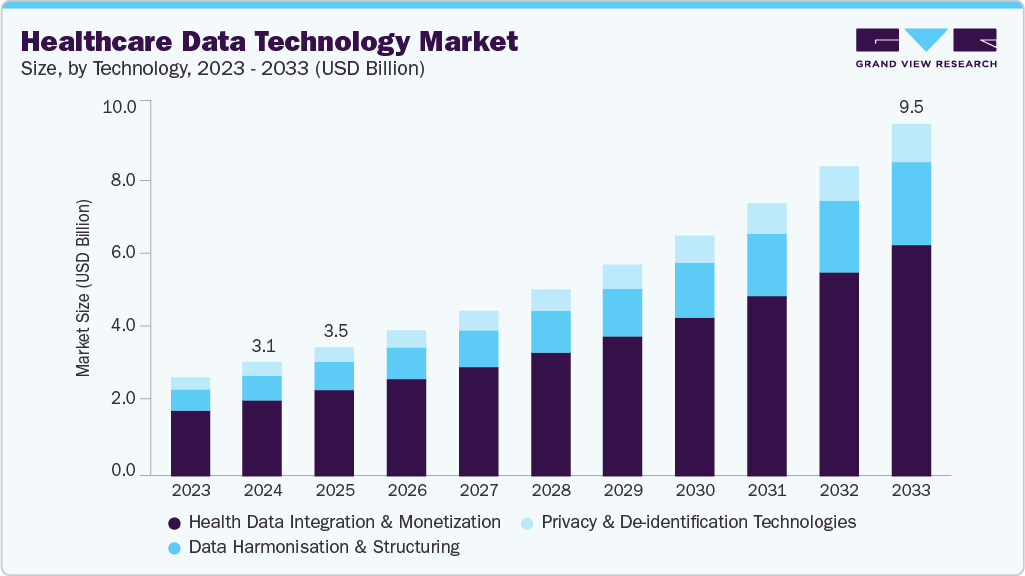

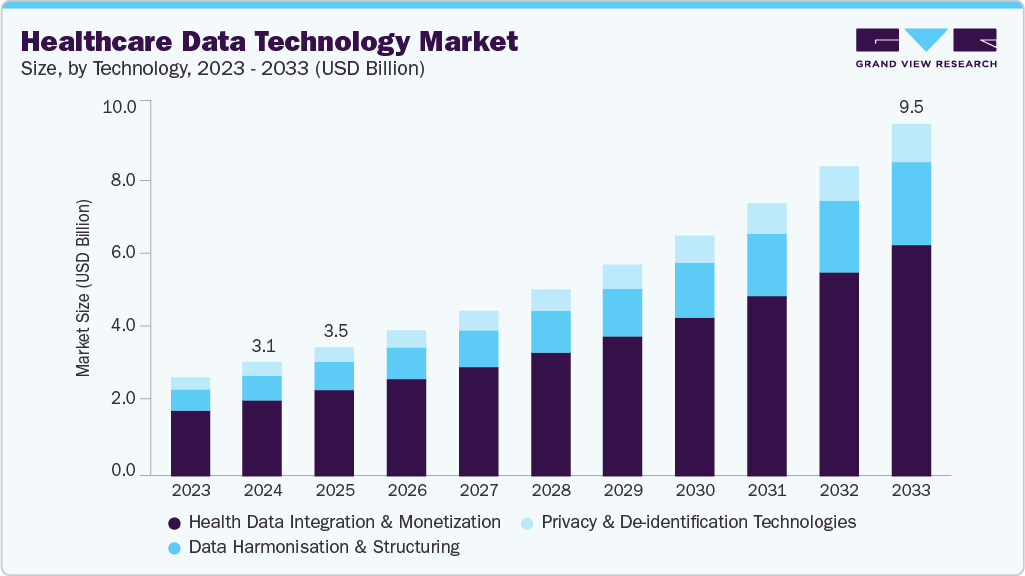

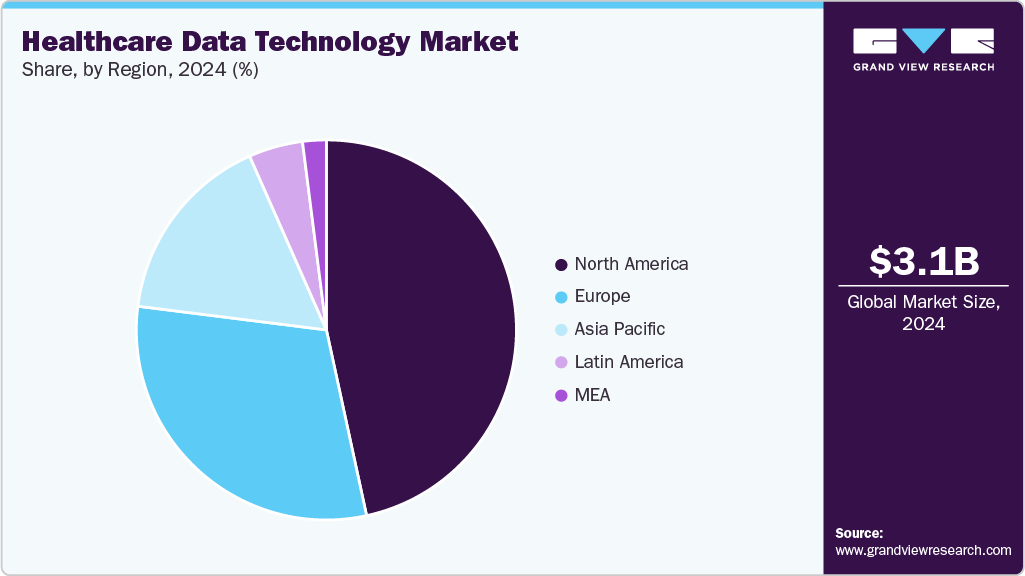

The global healthcare data technology market size was estimated at USD 3.10 billion in 2024 and is projected to reach USD 9.5 billion by 2033, growing at a CAGR of 13.36% from 2025 to 2033. Market growth is driven by the increasing volume of health data from EHRs, connected devices, and real-world evidence.

Key Market Trends & Insights

- North America dominated the market in 2024.

- The Healthcare Data Technologymarket in the U.S. has grown significantly over the forecast period.

- By technology, the health data integration & monetization segment led the market with a share of over 66.55% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.10 Billion

- 2033 Projected Market Size: USD 9.5 Billion

- CAGR (2025-2033): 13.36%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The adoption of AI, advanced analytics, interoperability solutions, and a growing focus on data privacy and monetization further accelerates market expansion. In December 2024, according to CDC data, 88.2% of U.S. office-based physicians used an EMR/EHR system, with 77.8% using a certified system. Widespread EHR adoption is driving demand for healthcare data integration and analytics solutions.

The market is experiencing strong growth as healthcare organizations increasingly prioritize data integration, interoperability, and AI-driven transformation in their IT strategies. The sector’s rapid digitalization, driven by the need for unified patient data, efficient clinical workflows, and outcome-based care, leads to a fundamental reallocation of IT budgets. Organizations are shifting from traditional infrastructure toward integration-focused, cloud-enabled, and AI-supported systems, positioning data technologies at the core of operational and clinical innovation. This evolution underscores a growing recognition that effective data integration is crucial for attaining digital maturity, enhancing patient outcomes, and facilitating the adoption of next-generation healthcare delivery models.

Moreover, the market is experiencing significant growth fueled by global and national initiatives to harmonize, standardize, and integrate healthcare data. Organizations and governments are increasingly investing in strategies that combine clinical, social, and operational datasets to enhance patient care, support research, and enable value-based healthcare models. Partnerships among technology vendors, public health agencies, and international bodies drive the adoption of interoperable standards, the integration of social determinants of health (SDOH), and advanced data-sharing frameworks. These efforts are expanding the availability and usability of health data, creating a robust ecosystem where analytics, AI, and predictive modeling thrive. This positioning of data harmonization and structuring as a critical driver for healthcare innovation and operational efficiency is key.

-

In October 2025, Australia announced a USD 3.88 million national project to harmonize hospital electronic medical records (EMRs). The initiative aligns hospital data with global standards, enabling secure data sharing and research through collaboration between public hospitals and universities.

-

In September 2025, the EU’s EHDS represents the world’s largest healthcare data harmonization effort, mandating interoperable data access across all EU countries for care and research. The project has defined implementation milestones extending through 2028 and is expected to accelerate the development of AI-based tools and analytics by providing standardized, high-quality data across borders.

-

In February 2025, HealthEdge Software, Inc. and Unite Us partnered to embed SDOH data directly into HealthEdge’s GuidingCare platform. This integration allows care managers to efficiently address members’ social needs, aligning with evolving CMS requirements for comprehensive care.

Technology Overview: Existing and Emerging: Data Harmonization & Structuring

Existing technologies in data harmonization focus on consolidating disparate healthcare data sources into consistent, structured formats. ETL pipelines, HL7/FHIR-based standardization, and enterprise data warehouses are widely used to integrate EHRs, lab systems, imaging metadata, and claims data. These tools enable analytics-ready datasets and facilitate reporting, population health management, and clinical research.

Emerging approaches leverage AI, graph-based databases, and federated frameworks to handle complex, multi-institutional datasets. Graph databases capture the relationships between patients, genomic data, and clinical outcomes, while AI-driven semantic mapping reduces the need for manual standardization. Federated harmonization allows collaborative research without centralizing sensitive patient data, improving scalability and compliance.

- Example Data Harmonization & Structuring

|

Technology Type

|

Existing / Emerging

|

Example Platforms / Tools

|

Application / Implementation

|

|

ETL & Data Pipelines

|

Existing

|

Talend, Informatica, SSIS

|

Mayo Clinic integrates EHR, lab, and imaging data for structured research datasets.

|

|

HL7 / FHIR Standardization

|

Existing

|

Epic FHIR APIs, Cerner FHIR

|

Epic Care Everywhere enables interoperable patient data sharing across hospitals.

|

|

Data Warehousing

|

Existing

|

Snowflake, Oracle Health Sciences DW

|

Cleveland Clinic consolidates EHR, lab, and imaging data for predictive analytics

|

|

Graph-based Harmonization

|

Emerging

|

Neo4j, TigerGraph

|

BC Platforms maps genomic & clinical data relationships for research insights

|

|

AI-driven Semantic Mapping

|

Emerging

|

Aridhia, Ontotext

|

Accelerates multi-center clinical trials by automating data mapping

|

|

Federated Harmonization

|

Emerging

|

OHDSI, MedCo

|

Enables multi-institution research without centralizing sensitive patient data

|

Market Concentration & Characteristics

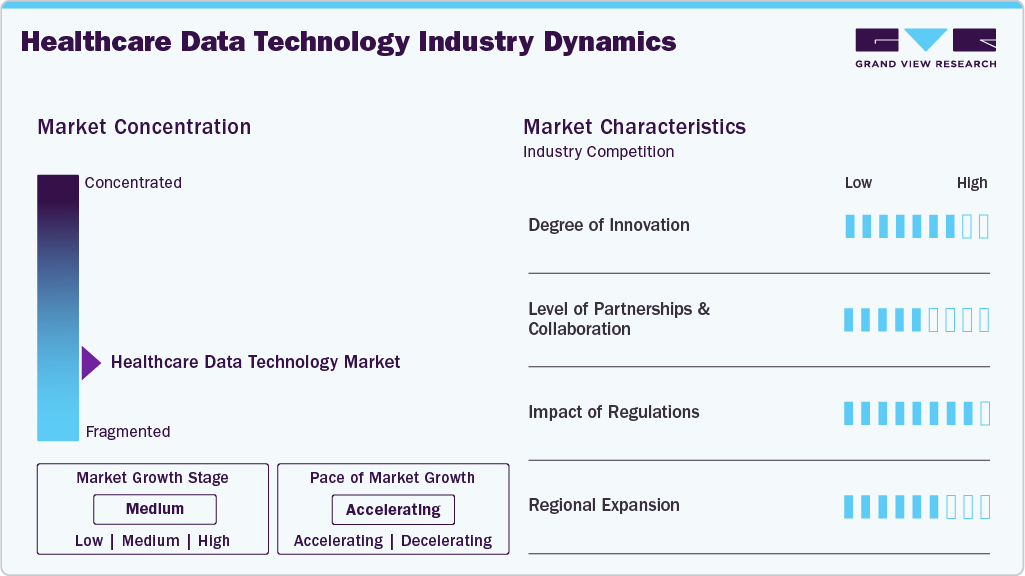

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the healthcare data technology industry is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, regional expansion is experiencing moderate growth.

The healthcare data technology industry is evolving rapidly with the integration of advanced analytics, AI, and cloud-based platforms to enhance data interoperability, security, and real-time decision-making. Innovations in predictive analytics, federated learning, and blockchain are enabling seamless, compliant data exchange across healthcare ecosystems, improving clinical insights, operational efficiency, and patient outcomes. For instance, in October 2025, Lifebit Biotech Inc. launched its AI-powered Trusted Data Factory and Trusted TargetID at BioTechX Basel 2025, enabling rapid harmonization of multi-modal biomedical datasets and AI-driven target discovery.

The healthcare data technology industry is expected to experience significant growth, driven by strategic collaborations and ecosystem partnerships that aim to advance data interoperability, enhance cybersecurity frameworks, and enable AI-driven analytics. For instance, in October 2025, Informatica, Inc. expanded its collaboration with Oracle to enhance AI and data management on Oracle Cloud Infrastructure (OCI), introducing an Agentic AI blueprint, native Master Data Management (MDM) on OCI, MCP server support, and full IDMC platform deployment for secure, regulated cloud environments.

Regulations have a significant impact on the healthcare data technology industry, as stringent data privacy and security laws, such as HIPAA and GDPR, and regional health data governance frameworks, mandate robust compliance and transparency in data handling. These regulatory requirements drive innovation in secure data management solutions, encryption, and audit capabilities while also increasing implementation complexity and costs for providers and vendors.

The healthcare data technology industry is witnessing strong growth across regions, driven by increasing adoption of electronic health records (EHRs), rising demand for interoperable and secure data exchange, and the growing use of AI and analytics for clinical and operational insights. Strategic partnerships and acquisitions further accelerate market expansion by strengthening regional presence and enhancing solution capabilities. For instance, in May 2025, Huma partnered with Eckuity Capital and acquired Aluna, a US-based remote monitoring company, expanding its reach in respiratory health and integrating Aluna’s solutions into the Huma Cloud Platform.

Case Study: Scalable Medicaid Data Integration For Healthcare Providers

Client Background / Challenge

A Medicaid-focused healthcare provider was struggling with fragmented and manual data integration processes, which created operational bottlenecks, delayed claim processing, and posed compliance risks with evolving Medicaid regulations. Their data sources included claims, patient records, and lab results across multiple legacy systems. The organization needed a scalable, automated, and regulation-compliant solution.

Solution Overview

The provider implemented PilotFish’s integration platform, which enabled:

-

Real-time Medicaid data processing

-

Automated data transformation into standard formats

-

Embedded compliance checks throughout the workflow

Implementation Highlights

|

Component

|

Description

|

Key Actions / Features

|

Benefits

|

|

Data Transformation

|

Converting heterogeneous Medicaid data into a standard format

|

Automated ETL, HL7/FHIR mapping

|

Reduced manual intervention, minimized errors

|

|

Real-Time Processing

|

Processing claims and patient data instantly

|

Streaming integration pipelines

|

Faster claims processing, up-to-date patient data

|

|

Compliance Checks

|

Ensuring adherence to Medicaid regulations

|

Rule-based validation & automated alerts

|

Reduced regulatory risk

|

|

Scalability

|

Handling growing data volumes as operations expand

|

Cloud-native infrastructure, auto-scaling

|

Future-proof integration capability

|

Outcomes / Impact

|

Area

|

Before Implementation

|

After Implementation

|

Improvement

|

|

Compliance

|

Partial compliance, risk of penalties

|

Full Medicaid compliance

|

100% adherence

|

|

Operational Efficiency

|

Manual processing, slow claim handling

|

Automated workflows

|

50-60% faster claim processing

|

|

Data Accuracy

|

Frequent errors due to manual entry

|

Minimal errors, automated validation

|

~90% reduction in data errors

|

|

Scalability

|

Limited ability to handle growth

|

High-volume integration support

|

Supports all future expansion

|

Key Takeaways / Insights

-

Automating Medicaid data workflows dramatically reduces operational overhead.

-

Embedding compliance checks ensures regulatory adherence without manual effort.

-

Scalable architecture future-proofs healthcare providers against data growth and system expansion.

Technology Insights

Based on technology, the health data integration & monetization segment accounted for the largest revenue share of 66.55% in 2024. The growing need to unify diverse healthcare datasets, including EHRs, clinical trial data, and real-world evidence, is driving this segment. Adoption of interoperable platforms, cloud infrastructure, and analytics tools that enable secure data exchange and monetization further supports growth. In March 2025, IgniteData launched its Archer platform at Cambridge University Hospitals in collaboration with AstraZeneca to integrate EHR and EDC systems for a Phase 3 clinical trial.

The data harmonization & structuring segment is anticipated to grow at the fastest CAGR over the forecast period. The adoption of artificial intelligence and natural language processing to standardize unstructured clinical data is driving the segment growth. Rising demand for unified data models, interoperability, and automated curation tools enables actionable insights from EHRs, imaging, and genomic datasets. In October 2025, Mount Sinai researchers developed the InfEHR AI system to transform unstructured and scattered electronic health record data into structured, patient-specific diagnostic insights.

Regional Insights

The healthcare data technology market in North America is experiencing significant growth, driven by substantial investments and strategic initiatives across the U.S., Canada, and Mexico. These developments aim to enhance data integration, support the adoption of artificial intelligence (AI), and improve patient outcomes. In the U.S., for instance, in July 2025, a notable development is the acquisition of Xealth, a U.S.-based healthcare platform, by Samsung Electronics. While the financial terms of the deal were not disclosed, Samsung aims to integrate its wearable technology with Xealth’s platform, which supports digital health programs and connects over 500 U.S. hospitals with patients.

U.S. Healthcare Data Technology Market Trends

The healthcare data technology market in the U.S. has been expanding its health data infrastructure through federal policy, regulatory mandates, research funding, and certifying standards aimed at improving interoperability, enabling secondary use of data, and advancing patient outcomes. According to the U.S. Department of Health and Human Services (HHS) article published in September 2025, one major signal of this push is the renewed “crackdown on health data blocking”, whereby HHS is directing increased enforcement of the 21st Century Cures Act information blocking rules to ensure patients and providers can access and exchange electronic health information more freely.

Europe Healthcare Data Technology Market Trends

The healthcare data technology market in Europe is experiencing significant growth, driven by policy harmonization, the deployment of interoperable health data infrastructures, and the establishment of cross-border data governance frameworks. The most pivotal development shaping the sector is the European Health Data Space (EHDS) Regulation, formally adopted in March 2025. The EHDS establishes a legally binding framework for the use, exchange, and secondary utilization of electronic health data across EU member states. It covers two core pillars for primary data use (enabling citizens and healthcare professionals to access and share health data securely across borders), and HealthData EU for secondary data use. This regulation mandates interoperability, cybersecurity, and strict patient consent mechanisms, while defining priority data categories, including patient summaries, e-prescriptions, laboratory results, and medical imaging, to ensure seamless data exchange across the region.

The UK healthcare data technology market is expected to grow over the forecast period. The UK has been rapidly scaling up its healthcare data technology infrastructure, driven by national policy, regulatory mandates, and investment aimed at improving integration, accelerating research, and enhancing patient outcomes. According to the Reuters article published in April 2024, a significant signal of this is the UK Government’s announcement in April 2025 of a USD 790 million (£600 million) investment to establish a new national Health Data Research Service by the end of 2026. This initiative aims to centralize NHS health data into a secure, user-friendly system, thereby reducing fragmentation and accelerating clinical research and trials.

The healthcare data technology market in Germanyhas been strengthening its digital health infrastructure through legislation, strategic investments, and regulatory reforms aimed at better data access, integration, research enablement, and improving patient-centered care, contributing to market growth. According to a Nature article published in April 2025, Germany has launched a €500 million (USD 577.8 million) medical informatics funding scheme aimed at making secondary life-science and health data more accessible, supporting integration across research, care, and innovation.

Asia Pacific Healthcare Data Technology Market Trends

The healthcare data technology market in Asia-Pacific is experiencing significant growth, driven by national policies, regulatory mandates, and investments aimed at improving integration, accelerating research, and enhancing patient outcomes. For instance, in the first half of 2025, APAC digital health funding reached USD 1.2 billion, with AI-powered ventures capturing 63% of the capital. This surge in investment reflects a strong focus on artificial intelligence (AI), particularly in areas such as medical diagnostics, research solutions, and health management systems.

Japan healthcare data technology market is expanding steadily, driven by the government’s focus on digital health innovation, the aging population’s needs, and nationwide interoperability initiatives. The increasing adoption of AI, big data analytics, and cloud-based platforms is enhancing clinical decision-making, operational efficiency, and personalized care delivery.

The healthcare data technology market in China is growing rapidly, driven by strong government initiatives that promote digital health transformation and the integration of AI technologies into clinical decision-making and hospital operations. For instance, DeepSeek, an AI system widely deployed across China’s tertiary hospitals since January 2025. Initially implemented in Shanghai’s major medical institutions, it has since expanded nationwide, enhancing diagnostic accuracy, streamlining workflows, and improving patient management.

Latin America Healthcare Data Technology Market Trends

The healthcare data technology market in Latin America is gradually evolving, driven by both the need to address longstanding health system challenges and the opportunities presented by emerging technologies such as artificial intelligence (AI), according to the Council on Foreign Relations. An article published in November 2024, the COVID-19 pandemic highlighted the vulnerability of Latin American health systems, exposing inequities, overburdened services, and resource limitations while also triggering heightened levels of anxiety, burnout, depression, and posttraumatic stress disorder among healthcare workers. These challenges underscore the urgent need for modernization and innovation in health data management and technology infrastructure.

Middle East & Africa Healthcare Data Technology Market Trends

The healthcare data technology market in the Middle East and Africa (MEA) is experiencing significant growth, driven by national policies, regulatory mandates, and investments aimed at improving integration, accelerating research, and enhancing patient outcomes. For instance, in July 2025, the implementation of the UAE’s National AI Strategy 2031 aims to integrate AI across key sectors, including healthcare, education, and transportation.

Key Healthcare Data Technology Company Insights

The market is highly fragmented, with a mix of small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key Healthcare Data Technology Companies:

The following are the leading companies in the healthcare data technology market. These companies collectively hold the largest market share and dictate industry trends.

- IQVIA

- Veeva Systems

- Medidata (Dassault Systemes)

- BC Platforms

- Quantexa

- Lifebit Biotech Inc.

- FITFILE

- Umedor Ltd

- Aridhia Digital Research Environment

- OM1

- Syneos Health

- Thermo Fisher Scientific Inc.

- Health Data Technologies GmbH

- TriNetX, LLC

- Flatiron Health

- Arcturis Data Limited

- CRIStal Health Limited t/a Akrivia Health

- Holmusk

- Huma

- ICON, plc

- Privitar (Informatica Inc.)

- Datavant

- CogStack

- Evidentli

- The Hyve

- DataRobot, Inc.

- CLARIFY

- Komodo Health, Inc.

- Evidation Health, Inc.

- Oracle (Cerner Corporation)

- Optum, Inc. (UnitedHealth Group)

- Veradigm LLC (formerly Allscripts Healthcare Solutions, Inc)

- DECENTRIQ

- Shaip

- Satori Cyber Ltd

- LynxCare

Recent Developments

-

In October 2025, Oracle launched the Oracle AI Data Platform, a comprehensive solution that unifies enterprise data with generative AI models and automation tools. The platform enables businesses to create AI-ready data lakes, deploy agentic applications, and streamline workflows, offering real-time insights and operational efficiency.

“Oracle AI Data Platform enables customers to get their data ready for AI and then leverage AI to transform every business process. By unifying data and simplifying the entire AI lifecycle, Oracle AI Data Platform is the most comprehensive foundation for enterprises seeking to harness the power of AI with confidence, security, and agility.”

-T.K. Anand, executive vice president

-

In October 2025, UnitedHealth Group’s Optum division announced plans to acquire Acton Medical Associates, a 45-doctor primary care practice in the Boston area. The acquisition highlights Optum’s continued expansion of its physician network despite challenges in the broader business.

-

In September 2025, FITFILE joined the EHDS4All initiative to support cross-border health data collaboration across Europe. The company aims to enhance interoperability, enabling researchers, clinicians, and policymakers to access large-scale insights while maintaining privacy and security, advancing data-driven innovation in healthcare.

“This is more than data sharing, it’s about building trust, transparency, and transformative impact across borders. We’re proud to be involved in this movement, helping to shape a healthier, more connected Europe.”

-said Philip Russmeyer, Founder and CEO at FITFILE

-

In August 2025, IQVIA and Veeva Systems formed long-term global partnerships, enabling customers to use their software, data, and services together for faster, more efficient clinical trials and commercialization.

“IQVIA and Veeva’s partnerships bring together best-in-class capabilities in information, AI, technology, and services for our shared clients. This will enable IQVIA customers on Veeva platforms to accelerate clinical development, bring treatments to market more efficiently, and improve access to innovations for patients.”

-Ari Bousbib, chairman and CEO of IQVIA.

-

In July 2025, Commvault announced plans to acquire Satori Cyber Ltd to enhance its data security capabilities for generative AI. The acquisition will integrate Satori’s platform into Commvault Cloud, adding compliance, risk mitigation, and sensitive data access controls. Most of Satori’s team will transition into Commvault roles.

“As enterprises accelerate AI and modern data platform adoption, securing sensitive data across distributed environments grows increasingly complex, By integrating Satori’s real-time, agentless controls and deep visibility into structured and AI training data, we’re extending our cyber resilience into the data layer enabling secure data access, AI governance, and policy enforcement across platforms like Snowflake, Redshift, and Databricks to reduce risk and drive compliant innovation.”

– Rajiv Kottomtharayil, Chief Product Officer, Commvault.

Healthcare Data Technology Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 3.50 billion

|

|

Revenue forecast in 2033

|

USD 9.5 billion

|

|

Growth rate

|

CAGR of 13.36% from 2025 to 2033

|

|

Actual data

|

2021 – 2024

|

|

Forecast period

|

2025 – 2033

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Technology, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

|

|

Key companies profiled

|

IQVIA; Veeva Systems; Medidata (Dassault Systemes); BC Platforms; Quantexa; Lifebit Biotech Inc.; FITFILE; Umedor Ltd; Aridhia Digital Research Environment; OM1; Syneos Health; Thermo Fisher Scientific Inc.; Health Data Technologies GmbH; TriNetX, LLC; Flatiron Health; Arcturis Data Limited; CRIStal Health Limited t/a Akrivia Health; Holmusk; Huma; ICON, plc; Privitar (Informatica Inc.); Datavant; CogStack; Evidentli; The Hyve; DataRobot, Inc.; CLARIFY; Komodo Health, Inc.; Evidation Health, Inc.; Oracle (Cerner Corporation); Optum, Inc. (UnitedHealth Group); Veradigm LLC (formerly Allscripts Healthcare Solutions, Inc); DECENTRIQ; Shaip; Satori Cyber Ltd; LynxCare

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Healthcare Data Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global healthcare data technology market report based on technology and region:

-

Technology Outlook (Revenue, USD Million, 2021 – 2033)

-

Health Data Integration & Monetization

-

Data Integration Platforms

-

Data Monetisation/Analytics Enablement

-

Data Linkage & Record Matching

-

-

Data Harmonisation & Structuring

-

Preprocessing/Analytic Readiness

-

Data Standardisation Tools

-

Third-party Data Enrichment

-

-

Privacy & De-identification Technologies

-

Reversible De-ID/Pseudonymisation

-

Irreversible Anonymisation

-

Privacy Compliance & Governance Tools

-

-

-

Regional Outlook (Revenue, USD Million, 2021 – 2033)

link